It’s 2025, which means it’s time to ditch the fax machine. We’ve got AI copilots writing code, supply chains stretching across continents, and quantum computing knocking on the door. Yet somehow, some businesses are still clinging to email threads, PDF attachments, and yes, the occasional fax to manage trading partner communications.

That friction? It’s costing time, money, and trust.

The good news is that there are vendors who can manage the complexity of global commerce. The better news is that it’s never been easier to choose a solution that fits your business needs.

Let’s break down how to find the best B2B integration solution for you, without the jargon or guesswork.

What B2B integration looks like in 2025

Once upon a time, B2B integration meant Electronic Data Interchange (EDI) and not much else. Today, it’s a dynamic ecosystem built for real-time, API-driven exchanges, AI-backed workflows, and seamless collaboration.

Modern B2B and EDI vendors are able to connect you with everyone in your orbit: suppliers, logistics providers, banks, and beyond, no matter their tech stack or size. Whether it’s streamlining order fulfillment or ensuring financial compliance, these systems are the unsung heroes behind high-performing supply chains.

What to look for in a B2B integration solution

Choosing the right B2B integration capabilities isn’t about checking boxes. It’s about enabling the outcomes that matter to your business. Look for solutions that offer:

Modern platforms must accommodate a wide range of data formats. Structured and unstructured, digital and analog. This means they need to be able to do more than just accept EDI or API-based transactions.

A truly capable solution can ingest and transform PDFs, spreadsheets, flat files, XML, legacy system outputs, emails, faxes, and even handwritten or scanned documents into clean, structured, and usable data.

Why does this matter?

Because not every trading partner is on the same digital maturity curve. Some may be running decades-old ERPs with no API access. Others might send invoices as image-based PDFs or submit orders via email attachments. Forcing these partners to adopt your systems (or delaying integration until they do) can create costly onboarding delays and jeopardize business relationships.

Instead, a flexible integration platform meets each partner where they are. Using intelligent document processing (IDP), optical character recognition (OCR), and machine learning, leading solutions can:

- Extract and validate key data from unstructured sources in real time

- Standardize and enrich that data with business rules and partner-specific mappings

- Push clean data into your ERP, WMS, TMS, or CRM with full traceability

This capability eliminates the need for manual data entry and reduces the risk of costly errors or compliance violations. It also enables your internal teams to operate with more reliable, timely information across critical functions like procurement, logistics, finance, and customer service.

2. End-to-end order and invoice automation

Automating your full order-to-cash (O2C) and procure-to-pay (P2P) processes eliminates manual bottlenecks and keeps operations running smoothly. Instead of chasing down emails or correcting entry errors, you enable seamless, real-time transaction flows across your supply chain and finance teams.

A robust platform should automate:

- Purchase orders, confirmations, and shipping notices

- Invoices, validation, and three-way matching

- Payments, remittance, and compliance reporting

Look for solutions with smart validation rules, automated workflows, and ERP/payment system integration to ensure data accuracy and reduce cycle times.

Crucially, automation also supports compliance with global e-invoicing mandates, from Italy’s SDI to Brazil’s Nota Fiscal, so you can expand across regions without extra overhead.

Ultimately, automation will mean faster transactions, fewer errors, and more resilient supply chain and finance operations, all while meeting regulatory requirements.

3. AI-powered workflows

Artificial intelligence is no longer a futuristic concept. In B2B integration, AI now plays a vital role. Leading platforms use AI to flag data anomalies, suggest workflow optimizations, and even auto-correct issues before they cause a disruption.

Continuous intelligence through AI can:

- Flag data anomalies before they cause downstream errors

- Recommend workflow improvements based on historical patterns

- Auto-correct formatting or validation issues in real time

- Prioritize tasks or alerts based on business impact

By learning from past behavior and identifying trends across large volumes of transactions, AI enables predictive insights. For example, if a supplier typically ships late, AI can flag risk earlier and suggest proactive steps to avoid delays.

This intelligence runs quietly in the background, reducing the noise your teams deal with daily. It helps your staff spend less time on low-value exception handling and more time on strategic, higher-impact work, leading to Smoother operations, fewer errors, and faster decisions.

4. Global financial and treasury integration

As organizations expand across borders, managing financial operations becomes exponentially more complex. Modern B2B integration platforms eliminate fragmentation by connecting payment, banking, and treasury systems into a unified financial ecosystem. This allows finance teams to centralize control while still supporting regional and local nuances.

Key capabilities to look out for when evaluating BB integration software include:

- Automated payment processing across multiple banks and currencies

- Integration with treasury management systems for cash forecasting and liquidity planning

- Compliance support for regional tax, invoice, and e-payment regulations

- Consolidated reporting across subsidiaries, geographies, and business units

With everything connected, you gain real-time visibility into global cash positions, simplify reconciliation, and reduce the risk of payment delays or regulatory missteps. This means you’ll have a more agile, compliant, and insight-driven finance operation that can scale with your business, no matter how global it becomes.

5. Partner ecosystem management

Your business doesn’t operate in a vacuum. It thrives on the strength of its partner ecosystem. Suppliers, logistics providers, retailers, banks, and service providers all play critical roles. Managing these relationships at scale requires more than email chains and spreadsheets.

A modern B2B integration platform should act as a supply chain collaboration hub that simplifies how you onboard, manage, and grow partner relationships. That starts with intuitive, self-service onboarding, allowing partners to connect quickly without heavy IT involvement. The faster a partner is up and running, the faster you can transact and deliver value.

But onboarding is just the beginning. The right platform should also offer:

- Role-based access and permissions to ensure data security and process clarity

- SLA and performance dashboards that track fulfillment rates, delivery times, and error trends

- Built-in messaging and alerting tools to streamline communication

- Automated testing and certification to validate document formats or compliance standards

This level of visibility and automation strengthens trust. When partners know they’re working within a reliable, transparent framework, collaboration becomes smoother and more resilient.

6. Secure file transfers

Not all business-critical documents fit neatly into structured data fields. From technical blueprints and product specifications to regulatory certificates and compliance reports, many files are too large or too sensitive for traditional channels like email or consumer-grade file-sharing tools. Secure managed file transfer ensures that your data gets where it needs to go, fast, encrypted, and fully auditable

Modern B2B integration platforms should include secure, high-performance file transfer capabilities built to handle large payloads and sensitive content with confidence. These tools go far beyond simple upload/download functions. They offer:

- End-to-end encryption in transit and at rest

- Role-based access controls and user authentication

- Audit logs and tracking to ensure full visibility and traceability

- Automated routing and delivery based on file type, recipient, or workflow triggers

- Support for industry compliance standards (e.g., GDPR, HIPAA, ISO 27001)

Whether you’re sending design documents to a manufacturing partner or submitting compliance data to a regulator, secure file transfer ensures that your information arrives quickly, safely, and within policy, with no risk of interception, misdelivery, or loss.

7. Real-time analytics

In today’s fast-moving business environment, it’s not enough to collect data. You need insights that drive action.

Today’s integration platforms should offer live dashboards and reporting tools that give you continuous visibility into your end-to-end operations. This enables businesses to proactively identify issues, optimize workflows, and drive better decisions in the moment.

Key analytics capabilities include:

- Transaction tracking to monitor success and failure rates in real time

- Exception reporting to detect and escalate supply chain disruptions

- Partner performance metrics tied to SLAs and key KPIs

- Predictive insights to anticipate delays, inventory risks, or compliance issues

- Custom dashboards tailored to roles across IT, procurement, finance, and operations

By surfacing actionable data instantly, analytics transform how teams respond to challenges, from spotting a pattern of late shipments to uncovering root causes of invoice discrepancies. And with AI-enhanced insights, you don’t just react. You optimize.

Why it matters: the business impact of B2B integration

B2B integration is a strategic enabler of growth, resilience, and trust. In a world where every delay, error, or miscommunication can ripple across global supply chains, the right integration platform keeps your business responsive, compliant, and competitive.

It’s about more than digitizing documents. It’s about:

- Connecting with any partner, anywhere

- Seeing supply chain risks before they happen

- Reducing manual errors and boosting data accuracy

- Accelerating time to market

- Making smarter decisions with predictive insights

- Meeting global compliance mandates (hello, e-invoicing)

- Flexing across hybrid, cloud, or API-first deployments

In short, it’s about connecting the dots between your systems, your partners, and your strategy, giving you the agility and intelligence to lead in any market condition.

How to choose the right B2B integration provider for you

Every business has unique systems, workflows, and partner networks. But choosing the right provider doesn’t have to be complicated. Asking the right questions helps you identify a solution that fits your current needs and scales with your future ambitions.

Consider:

- Can the provider support both EDI and modern APIs? You need a platform that bridges traditional systems and modern architectures, without forcing a rip-and-replace strategy.

- Will they work with any partner, regardless of technical maturity? Your network includes high-tech partners and those still using spreadsheets. A flexible provider should meet all of them where they are.

- Do they have the expertise and infrastructure to scale across regions and regulatory frameworks? Global expansion requires deep knowledge of local tax, compliance, and trading mandates.

- Do they offer the automation, visibility, and security your business requires? Look for solutions that streamline workflows, surface actionable insights, and protect sensitive data from end to end.

- Can they deploy the solution how you need it? Whether you’re cloud-first, hybrid, or still managing on-prem infrastructure, the platform should align with your IT strategy.

- Do they provide hands-on onboarding and long-term support? Initial implementation is only the beginning. You want a partner who will guide you through onboarding, updates, and evolving business needs.

And most importantly:

- Are they going to make your life easier and deliver ROI? The right provider will reduce operational burden, improve partner satisfaction, and prove their value through faster time to value and long-term efficiency gains.

Why OpenText Business Network deserves a look

OpenText didn’t just build a B2B integration platform; they’ve shaped the category. The OpenText Trading Grid platform is the world’s largest business network, supporting over 1 million trading partners and processing millions of transactions daily.

With OpenText, you benefit from:

- Secure managed services with global scale

- Built-in AI and operational analytics

- Compliance with regional mandates across the globe

- Community management that reduces partner friction

- End-to-end visibility into transactions and workflows

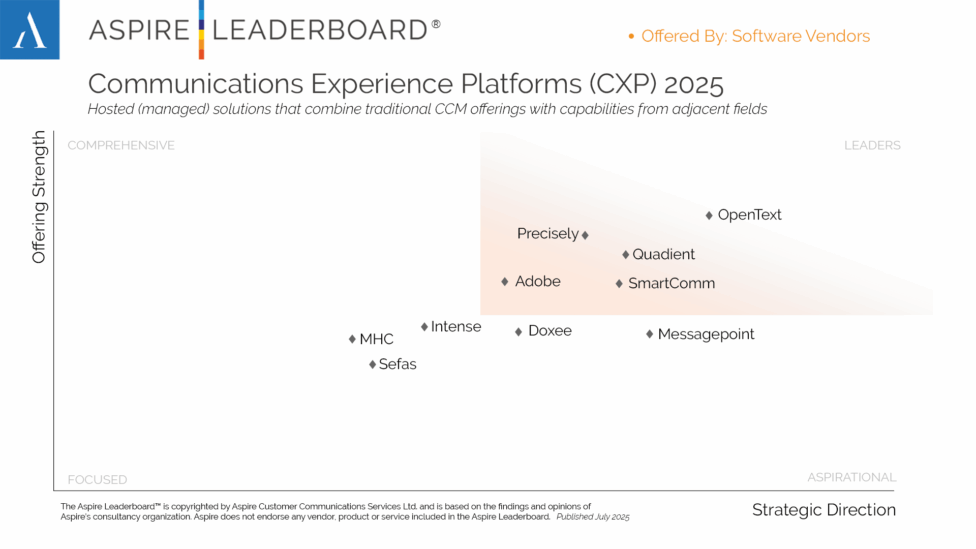

That’s why OpenText keeps showing up as a Leader in the IDC Marketscape for Multi-Enterprise Supply Chain Commerce Networks vendor assessment.

The future of B2B integration

The future is intelligent, connected, and frictionless. The right solution won’t just keep your operations and business compliant; it will unlock agility, resilience, and competitive edge.

Now is the time to modernize how you work with your partners. Explore what’s possible with the right B2B integration strategy.