The 2024 Payments Canada Summit recently concluded, bringing together industry leaders, innovators, and key stakeholders to discuss the most recent trends and insights in payments. As a lead sponsor of the event, OpenText made a significant impact at this year’s event by hosting two highly anticipated speaking sessions and making significant contribution to the overarching narrative at the conference. For those who missed this year’s event, a roundup of key insights, trends, and future insights has been compiled for you here.

Key trends and insights from the 2024 Payments Canada Summit

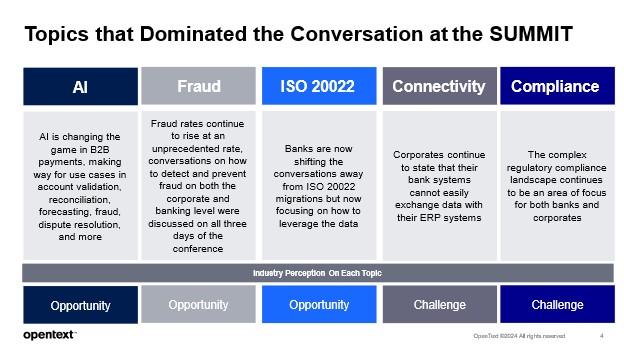

This year’s summit highlighted several pivotal trends that are shaping the future of the payments industry. From the integration of advanced technologies to navigating ISO 20022 migrations, the discussions previewed where the industry is making its investments for the future.

AI and automation

One of the most prominent trends at this year’s summit was the increasing integration of artificial intelligence and automation within the payments ecosystem. AI-driven solutions are transforming payment processes by enhancing efficiency, accuracy, and speed. From predictive analytics that help in fraud detection to intelligent automation that streamline routine tasks, AI is playing a critical role in reducing operational costs and improving customer experiences.

Enhanced security and fraud prevention

As digital payments become more prevalent, so do concerns about security and fraud. The Summit featured extensive discussions on the need for advanced security measures to protect sensitive data and ensure the integrity of transactions. Cybersecurity is a top priority, with organizations employing multi-layered security protocols, encryption, and real-time monitoring to detect and respond to threats. The implementation of AI and machine learning technologies is proving to be a game-changer in identifying and mitigating fraudulent activities, ensuring that both banks and their corporate clients are prepared to detect fraud before it even happens.

ISO 20022

ISO 20022 continued to be a key focus at the summit. Many banks and global financial institutions are recognizing the competitive advantages of early adoption, which include improved data quality, better regulatory compliance, and enhanced customer service. Most of the ISO 20022 related conversations shifted to focus mainly on these advantages, and less on implementations.

API and ERP connectivity

The integration of APIs and ERP systems is becoming increasingly important in the payments landscape. At the Summit, there was a strong emphasis on the need for robust API and ERP integration to support end-to-end payment processing. It was clear that solutions that can enable seamless connectivity, ensuring that organizations can efficiently manage their payment workflows and will be in a prime position to respond quickly to market demands.

Regulatory compliance

The Summit emphasized the importance of staying compliant with evolving regulations to avoid penalties and maintain client trust. Banks and corporates alike are investing in comprehensive compliance solutions to manage risk and ensure transparency in their operations.

OpenText weighs in on key topics

OpenText’s presence at the 2024 Payments Canada Summit was marked by two engaging and informative speaking sessions that drew considerable attention from both the bank and corporate perspectives.

Making the Most of AI in Payments

In this session, OpenText explored the transformative power associated with leveraging artificial intelligence in the payments industry. The discussion focused on how AI-driven solutions can enhance payment processes, improve security, and provide personalized customer experiences. Hosting industry leaders from JPMorgan Chase & Co. (JPMC) and the Bank of Montreal (BMO), this session was designed to showcase insights on how AI can help grow, run, and protect the bank. Panelists showcased insights into how each organization is currently using AI to improve processes internally as well as how it is being leveraged to improve the overall customer experience.

Turning ISO 20022 into a competitive advantage

OpenText delved into the strategic importance of ISO 20022. The session was designed to move past introductory implementation-based discussions and onto how this data-rich standard can be leveraged to achieve a competitive advantage. Thought leaders from the Bank of Montreal and Canadian Imperial Bank of Commerce (CIBC) joined OpenText to share how they have achieved success as well as reflect on lessons learned.

How OpenText is driving the future of payments

As OpenText looks toward the future of payments, our commitment to driving innovation remains. Following the Summit, our primary focus areas for the future include:

- Expanding AI and machine learning capabilities: OpenText aims to further build out its AI and machine learning capabilities to deliver more advanced automation and predictive analytics solutions. These technologies will play a crucial role in optimizing payment processes, improving security, and delivering industry-leading experiences.

- Innovating based on customer need: OpenText is committed to innovating based on customer needs, providing tailored solutions that address specific challenges faced by banks and corporate clients alike. By listening to customer feedback and understanding their pain points, OpenText will continue to develop solutions that deliver tangible value and drive business growth.

- Delivering comprehensive solutions to banks and their corporate clients: Recognizing the unique needs of both banks and their corporate clients, OpenText is committed to delivering tailored solutions that address specific challenges faced by each group. For banks, this includes optimizing payment processing and compliance, while for corporate clients, it involves providing tools for cash management, payment tracking, and financial reporting.

The 2024 Payments Canada Summit shone a light on the current and future trends taking place in the financial services industry. OpenText’s active participation and forward-thinking approach highlighted its commitment to leading the way in AI technologies, digital payment solutions, and innovation. As the industry continues to evolve, OpenText will remain at the forefront, driving progress and shaping the future of payments. Until next year!

Looking to learn more about OpenText financial services offerings? Check us out here.