February 2024

E-Invoicing mandate back on the agenda and planned for January 1 2026

Despite concerns that e-Invoicing would be off the table until late 2024, the Belgian finance minister has relaunched a legislative proposal to introduce mandatory e-invoicing for domestic business-to-business (B2B) transactions. The draft legislative proposal, adopted by the Council of Ministers on September 29, 2023, aims to implement the e-invoicing obligation on January 1, 2026.

The bill was approved by the Chamber of Deputies on 1 February 2024 and now awaits the royal seal and the publication in the official gazette. While Belgium still needs to receive a derogation from the European Commission in order to proceed, their application was submitted in October 2023 and there is no good reason to expect such a derogation would be refused. Still it remains an important milestone on the road to any e-Invoicing mandate.

What’s in scope?

The proposed B2B e-invoicing mandate includes all taxable persons established in Belgium and Belgian branches of foreign entities (foreign businesses with mere VAT registration in Belgium are not included).

Companies would be obliged to issue invoices in an electronic structured data format for domestic transactions in Belgium. The format proposed is PEPPOL-BIS UBL – which complies with the EU standard format EN-16931.

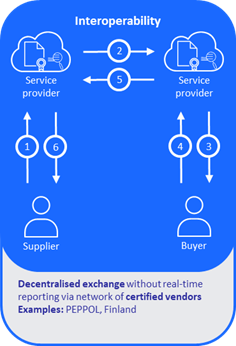

These invoices will need to be exchanged using the PEPPOL network or another compliant system agreed by both parties. PEPPOL was originally established for the purpose of business to government (B2G) e-Invoicing and although it has gradually been expanded for business to business (B2B) use cases it has yet to form the basis of a national B2B e-Invoicing mandate such as that proposed here so there is still certainly room for issues to arise during implementation of the mandate.

The PEPPOL network operates through certified Access Points which ensure data security, the integrity of transaction data, and the authenticity of the parties involved in any exchange. While companies are quite within their rights to purchase or build their own PEPPOL Access Point the model is mostly used through service providers like OpenText in what is effectively a “four-corner model” or interoperable model.

When the mandate goes live, sending of manual paper invoices, along with PDF invoices via email as well as other electronic invoicing approaches such as traditional EDI will no longer be allowed in a domestic B2B context.

This will result in significant disruption for businesses who have already invested in OCR technology or electronic invoicing solutions that rely solely on PDF or EDI.

What’s different from the previous attempt?

As we reported in our August 2023 update, political disagreements derailed the process previously – so what is different this time?

This time around, a single “big-bang” approach is being proposed with no phased implementation; the mandate would apply to all Belgian VAT-registered entities from January 1, 2026.

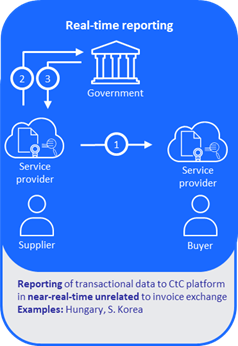

An associated e-reporting obligation is expected to be defined and introduced later, although most likely will simply be a straightforward 5-corner model as already used in countries like Hungary and South Korea, where service providers will report a subset of the invoice data to a government portal.

This is a very pragmatic approach, since, once the initial phase is over and all tax payers are successfully sending/receiving invoices and have reaped the benefits associated with eliminating manual invoices, it will be relatively straightforward to add the additional reporting step. If only all tax authorities took such a pragmatic approach that focuses first on the business benefits for taxpayers, before adding any additional burdens around tax reporting.

Be prepared

While we have seen high profile cases of countries delaying their e-Invoicing mandate the Belgian approach has been deliberately simplistic, leveraging the existing proven PEPPOL network in order to avoid potential complications around technical architecture and scalability.

Despite the seemingly distant implementation deadline, and the apparent simplicity of the model, businesses still start to prepare for the potential new mandate as soon as practical. If you are already using PEPPOL in Belgium, for example for B2G e-Invoicing, you may find there is less to do. But for those new to PEPPOL there is still some work to be done.

And of course Belgium is just one of many countries now who’s mandate will be coming soon. While Poland have postponed and no date has been set it will almost certainly be a 2025 deliverable, with Germany, Spain and Slovakia also due to begin their mandates in 2025. And 2026 will not only see Belgium introduce a mandate but also of course France, Croatia and Latvia.

For organizations with operations across these countries having to deal with not just one but two, three, four or even more mandates in quick succession will very likely leave you struggling for resources.

Beginning to address your global e-Invoicing strategy now makes a lot of sense.

August 2023

E-Invoicing launch delayed in Belgium due to political disagreements

Belgium’s plans to launch a PEPPOL based e-Invoicing model in July 2024 have collapsed. Parliamentary opposition parties rejected the proposal, citing a lack of confidence in the government’s revenue estimates from the proposal. The proposed e-Invoicing reforms aimed to increase tax revenue by reducing the VAT gap.

The withdrawal of the proposal means a substantial delay. Any fresh attempt to gather political agreement and revisit the reforms are impossible until after the summer elections in 2024.

Given the delay, it’s unlikely any e-Invoicing reform will come to Belgium before January 2026 at the earliest.

March 2023

Long-awaited tax reform proposal in Belgium finally announced

On 2nd March 2023, Belgian Finance Minister Vincent Van Peteghem took a significant step toward reform by launching a proposed first phase of the Belgian tax overhaul. After months of anticipation, his government formally presented the proposal it is now entering the legislative process. The goal? To solidify a reform plan by early April, followed by an official vote during the summer.

The proposed changes hold Companies face substantial implications for e-Invoicing and e-Reporting with these proposed changes. These should be phased in beginning 1st July 2024.

In response to a Parliamentary question, Van Peteghem confirmed that he intends to make the electronic issuing and receipt of invoices mandatory for a large majority of taxpayers.

The stated aim of the reform is to have a positive effect on the VAT gap, which accounted for 4.8BEuro or 14% of the expected Belgian VAT revenues as of 2020. The new obligations will decrease errors and restrict potential fraud, reducing the gap over time. The Belgian government is also preparting other measures to address this gap.

Van Peteghem recognized that the reforms proposed require an application for derogation from Articles 218 and 232 of the EU VAT Directive. He also confirmed that the Cabinet of the Ministry of Finance and the European Commission discussed this.

Technically the reform will require VAT registered Belgian taxpayers to send and receive structured electronic invoices for specific B2B transactions. The format will likely conform to the definition provided by the EU’s Vat In The Digital Age (ViDA) proposal, with PEPPOL expected to become the standard for exchanging e-Invoices.

Belgium has included e-Reporting obligations in the plans at the request of the European Commission. These will follow in a later phase. The current details are limited but the new obligations will likely fall in line with ViDA.

You can find details about the proposed Belgian tax reform, which also encompasses adjustments to VAT rates and more here.

April 2022

Mandatory B2G e-Invoicing moves forwards

Belgium’s plan to implement B2G e-Invoicing has proceeded with a Royal Decree that lays out the obligations for entrepreneurs. It also includes a timeline of implementation that will apply to all public contracts by 1st October 2023.

The official Royal Decree in Dutch is here.

March 2022

Benelux conference on VAT Gap

During a Brussles Benelux conference, Belgium, the Netherlands and Luxembourg called for co-operation to reduce the existing VAT gap in the EU. The VAT gap refers to the difference between expected VAT receipts and what the tax authorities had actually collected. Sharing good practices and knowledge should lead to more decisive and targeted action to detect fraud and ensure VAT is paid. In a region like Benelux, that is highly intertwined across borders and economically, this is especially true.

The loss of VAT revenue heavily affects public expenditure on goods and services such as schools, hospitals, transport and infrastructure. The missing funds could also address the many economic and health challenges surrounding the recovery from the COVID-19 pandemic.

Although the overall VAT gap in the EU Member States has narrowed since 2015, the EU countries all together still lost EUR 134 billion in VAT revenue in 2019. In addition to national action, the positive trend is also due to the EU making efforts to improve the situation. For example, there was a strong push towards the so-called transaction network analysis. Originally developed by the Benelux countries, 27 Member States are now able to identify cross-border fraud networks faster than before and target their investigations accordingly. According to Yuriko Backes, Luxembourg’s finance minister, the results of the automated data analysis tool (TNA) show an effectiveness in the fight against VAT fraud.

Benelux countries are convinced that with increased cooperation and knowledge sharing, they can take more targeted measures to put an end to VAT fraud.

February 2022

Update on Belgian B2B e-Invoicing mandate

Last month we mentioned the confirmation of Belgium’s plan to switch to mandatory e-Invoicing for B2B invoices.

On 10th February 2022, Mr Vincent Van Peteghem, Deputy Prime Minister and Minister of Finance in Belgium stressed the benefits of electronic invoicing for businesses as well as the state. It allows businesses to gain in productivity, he stated, by simplifying invoice processing and validation while combating tax fraud. The government is aware of the difficulties that could be faced by small businesses, which represent a large part of Belgium’s economic base. Van Peteghem indicated that Belgium is planning intensive exchanges with businesses and stakeholders to deploy the B2B electronic invoicing mandate project.

The proposed timing – mid-2023 – has raised objections from various stakeholders. The full scope of the proposed mandate remains undefined with no legislation in place, and no technical specifications published.

However, the Belgian government has confirmed that their model will be based on PEPPOL, which has an established network. This is quite a different approach to other member states, such as Italy and France, which developed their own platform/gateway. It will certainly accelerate the process.

We will share more information as it is made available.

January 2022

Belgium announces a gradual move towards mandatory e-Invoicing

The Belgian finance minister Vincent Van Peteghem has confirmed their intent to follow current trends and implement a mandatory e-Invoicing system.

The government will announce details of timeline and technical requirements in a legislative proposal in 2022.