The pressure on insurance companies has never been higher. The increasing competition for both customers and employees has cast a light on the need for high customer and employee satisfaction while also managing costs so that premiums can be market competitive. On the surface, this balancing act appears unwinnable, especially in an industry that has long relied on onsite knowledge workers, extensive documentation, and manual multi-step workflows for key operations such as claims processing.

How can insurers deliver fast, knowledgeable customer service to a market that increasingly communicates digitally by text and instant messaging? By joining the industry leaders who are embracing AI technologies, including generative AI content management, and are expecting 20-30% reductions in loss-adjustment expenses, as well as reductions in claims payouts. These leaders know that AI and automation is foundational to support successful customer-facing employees who are in limited supply and a must-have to satisfying and retaining customers.

Deliver key information faster and easier to frontline staff with an AI content assistant

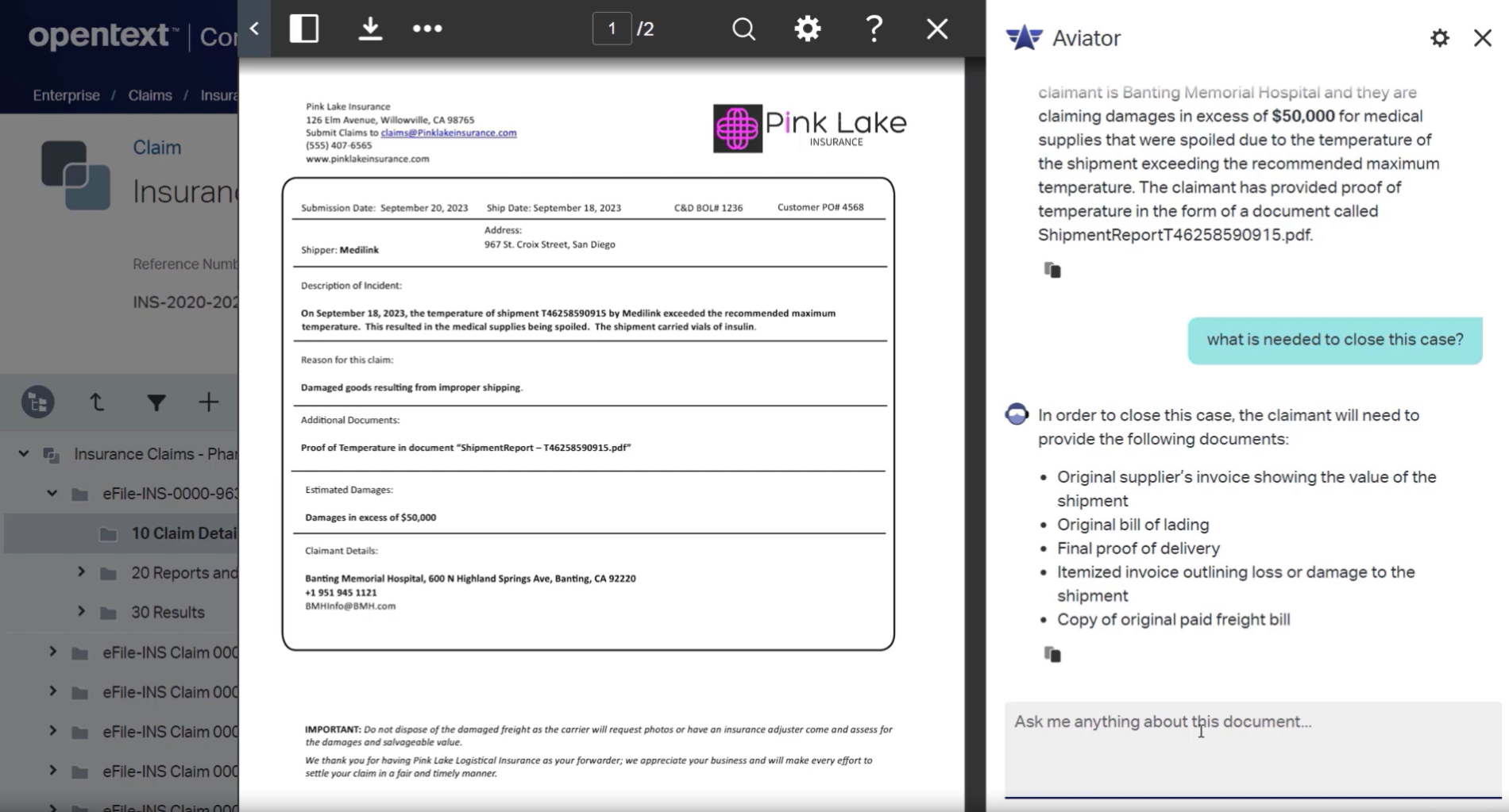

Starting with the first notice of loss (FNOL), your customer reaches out for help while in a difficult situation and feeling uncertain about what the claim processing experience will be like. Likewise, the assigned insurance claims rep is equally interested in a quick and successful resolution – to feel effective and positive about their role. Fortunately, even though the claims rep is new to the account, they can quickly ramp up their knowledge by typing questions into an AI content assistant available within the insurer’s content platform, such as OpenText™ Content Aviator, available for OpenText content management platforms. Within seconds and with no manual shifting through systems and documents, the insurance claims rep has this key information and is ready to help the customer get a quick resolution to the claim.

- Summary of the customer’s claim

- Required list of documents to close the case

- Similar cases that closed quickly without escalation

Empower employees to focus on higher value tasks

Still interacting with OpenText Content Aviator, the insurance claims rep requests text to send to the customer based on these prompts:

- customized for the specific claim

- includes a list of the required information that is needed

- written in the customer’s preferred language

The insurance claims rep uses a simple click to copy the communication and pastes it into the right communication channel for the customer. Now they can focus on complex claims that need human intervention – a much better use of their time than manually searching knowledge bases and communication templates for the right fit and language of content to send.

Satisfy customers with accelerated processes by knowledgeable support teams and AI content management

Throughout the claims processing experience, customers feel reassured working with a customer support team that has all their account information and knows how to smoothly move to the next steps. Customer satisfaction and retention improve by avoiding delays, eliminating unnecessary asks of the customer, and interacting with a confident customer support team. Check out this demo video of GenAI and OpenText Content Aviator to see an insurance adjustor and AI content assistant in action.

Go a step further with intelligent document processing solutions

Even with GenAI assisting frontline staff, insurers need to integrate AI into claims processing backends. Intelligent document processing enhances both speed and accuracy when capturing actionable data from inbound documents.

OpenText intelligent document processing solutions use machine learning and large language models to automate document capture, recognition, and classification. This automation significantly reduces the time and effort required to process claims, leading to faster resolutions and improved customer satisfaction.

IDP solutions accurately extract relevant information from claims forms, policy documents, and customer correspondence, giving claims adjusters immediate access to the information they need to make informed decisions, without manual data entry or extensive document searches.

Explore OpenText Capture and IDP solutions and take OpenText Content Aviator for a test drive to see more ways to supercharge insurance claims processing.

Try OpenText Content Aviator