Welcome to the February 2024 edition of our e-Invoicing & VAT compliance newsletter. This newsletter contains the most recent collection of updates to our real-time country updates blogs.

If you wish to keep abreast of the latest news from the OpenText Blogs page, navigate to “News & Events” and select e-Invoicing.

This issue, our Hot Topics section includes the news that Poland has postponed its e-Invoicing mandate, potentially indefinitely and address the question of what companies should do about this.

In “Compliance news and updates” you can read the latest world news on mandates as Malaysia moves towards their August 2024 mandate and Belgium’s mandate is back on the agenda for January 2026.

Meanwhile, we take a somewhat poetic look at the mandate in France and whether companies really need a certified provider or not – asking “To PDP, or not to PDP, that is the question”!

Hot topics

January 2024 – Poland’s e-Invoicing Mandate Postponed Indefinitely Due to System Errors

On 19 January 2024, Polish Finance Minister Andrzej Domański unexpectedly announced that the implementation of their proposed national e-Invoicing mandate had been postponed indefinitely.

This marks the second time Poland has postponed the mandate, having previously pushed it back six months from an original timeline of January 2024 to July 2024.

The KSeF system has been operational in a “voluntary phase” since January 2022, and businesses had been reassured by the Ministry of Finance that the KSeF system was ready for full implementation. This makes the recent discovery of critical errors and concerns about the platform’s ability to scale to the expected volumes of invoices all the more surprising. While the Ministry had previously claimed the system was capable of handling 100 million invoices per day, it appears that this figure may fall short of the actual demand due to peaks in processing on the first and last day(s) of each month.

Given the risk that businesses would be unable to issue invoices in the event of a system failure, the ministry has prudently decided to pause the mandate. A comprehensive external audit of the system is now planned to evaluate the issues and formulate a plan to resolve them. Only after the audit is complete and a remediation plan is in place will a new timeline be announced. The Ministry made clear that this will not be in 2024.

KSeF remains available on a voluntary basis

It remains unclear whether the Ministry will take this opportunity to address the already well-understood deficits in the KSeF system, such as the inability to include attachments with invoices issued through the platform. This common business practice is currently unsupported by the KSeF system, leaving businesses with the unenviable task of sending attachments separately via e-mail or other means, and buyers having to reconcile these attachments with the invoice received via KSeF.

Simultaneously, doubts have been raised about the compatibility of KSeF with the European Commission’s planned ViDA (VAT in the Digital Age) reforms. While ViDA has not yet been approved, it seems likely to proceed eventually, leaving Poland with a pressing need to adapt KSeF yet again to meet the demands of the reforms.

Although the Minister’s decision may be pragmatically welcomed as a step towards ensuring business continuity, it also comes as a blow to the many enterprises who have already invested in technology to connect to KSeF.

However, OpenText obtained confirmation directly from the Polish Ministry of Finance that: “KSeF still works in an optional version, and you can use it. Taxpayers can still integrate their financial and accounting programs with the National e-Invoice System.” In other words, KSeF is still available to be used on a voluntary basis as it has been since January 2022, and Polish companies can continue to roll out their e-Invoicing solution leveraging KSeF.

A unique opportunity to explore the benefits of e-Invoicing

As we all know, there are significant benefits in switching to electronic invoicing, in terms of reducing the costs and effort associated with manual invoice handling. This leads to faster payments, improved cash flow, and better customer and supplier relationships.

For suppliers sending invoices to their customers, there remains an obligation to obtain consent from your buyer to switch to electronic invoicing. However, the buyer does not need to establish a direct API connection to KSeF in order to receive their invoices electronically. They can register to manually download invoices from the KSeF portal in either PDF, XML, or HTML format. Multiple invoices can be downloaded together in ZIP format.

Buyers receiving invoices from their vendors can proactively provide consent in order to begin receiving their invoices. It seems likely that larger suppliers will be keen to proceed with automated e-Invoicing due to all of the business benefits.

OpenText Professional Services Community Survey can assist clients by finding out which of their buyers are ready to receive e-Invoices via KSeF, and which of their larger suppliers are willing and able to send e-Invoices.

Businesses should therefore see this as an opportunity, rather than a setback. As governments recognize the complexity of national e-Invoicing regimes, businesses too must understand that this is going to be more complicated than they expect. This is especially true for multinational companies with entities operating in multiple regimes affected by the impending mandates not just in Poland but also Romania & Malaysia (2024 mandates), Germany, Greece, Spain, and Slovakia (2025 mandates), and France, Belgium, Croatia, and Latvia (2026 mandates).

This wave of impending mandates will drive incredible demands on businesses to modernize and digitize their entire order-to-cash and procure-to-pay processes in a very short space of time, and in a manner that facilitates far greater agility. An agile and robust global platform for electronic invoicing will be an absolute necessity in order to meet the requirements of multiple national mandates in a very short space of time.

Poland’s “voluntary option”, therefore, represents a perfect low-risk approach to trying and testing your e-Invoicing strategy and platform in advance of the next major mandate.

E-Invoicing & VAT Compliance news and updates

February 2024 – Belgium – e-Invoicing mandate back on the agenda and planned for January 1, 2026

Despite concerns that e-Invoicing would be off the table until late 2024, the Belgian finance minister has relaunched a legislative proposal to introduce mandatory e-invoicing for domestic business-to-business (B2B) transactions. The draft legislative proposal, adopted by the Council of Ministers on September 29, 2023, aims to implement the e-invoicing obligation on January 1, 2026.

The bill was approved by the Chamber of Deputies on 1 February 2024 and now awaits the royal seal and the publication in the official gazette. While Belgium still needs to receive a derogation from the European Commission in order to proceed, their application was submitted in October 2023 and there is no good reason to expect such a derogation would be refused. Still it remains an important milestone on the road to any e-Invoicing mandate.

What’s in scope?

The proposed B2B e-invoicing mandate includes all taxable persons established in Belgium and Belgian branches of foreign entities (foreign businesses with mere VAT registration in Belgium are not included).

Companies would be obliged to issue invoices in an electronic structured data format for domestic transactions in Belgium. The format proposed is PEPPOL-BIS UBL – which complies with the EU standard format EN-16931.

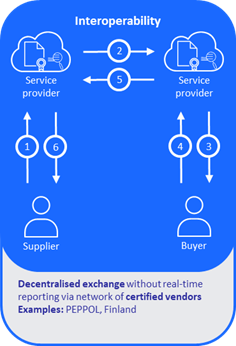

These invoices will need to be exchanged using the PEPPOL network or another compliant system agreed by both parties. PEPPOL was originally established for the purpose of business to government (B2G) e-Invoicing and although it has gradually been expanded for business to business (B2B) use cases it has yet to form the basis of a national B2B e-Invoicing mandate such as that proposed here so there is still certainly room for issues to arise during implementation of the mandate.

The PEPPOL network operates through certified Access Points which ensure data security, the integrity of transaction data, and the authenticity of the parties involved in any exchange. While companies are quite within their rights to purchase or build their own PEPPOL Access Point the model is mostly used through service providers like OpenText in what is effectively a “four-corner model” or interoperable model.

When the mandate goes live, sending of manual paper invoices, along with PDF invoices via email as well as other electronic invoicing approaches such as traditional EDI will no longer be allowed in a domestic B2B context.

This will result in significant disruption for businesses who have already invested in OCR technology or electronic invoicing solutions that rely solely on PDF or EDI.

What’s different from the previous attempt?

As we reported in our August 2023 update, political disagreements derailed the process previously – so what is different this time?

This time around, a single “big-bang” approach is being proposed with no phased implementation; the mandate would apply to all Belgian VAT-registered entities from January 1, 2026.

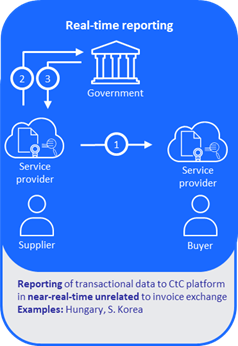

An associated e-reporting obligation is expected to be defined and introduced later, although most likely will simply be a straightforward 5-corner model as already used in countries like Hungary and South Korea, where service providers will report a subset of the invoice data to a government portal.

This is a very pragmatic approach, since, once the initial phase is over and all tax payers are successfully sending/receiving invoices and have reaped the benefits associated with eliminating manual invoices, it will be relatively straightforward to add the additional reporting step. If only all tax authorities took such a pragmatic approach that focuses first on the business benefits for taxpayers, before adding any additional burdens around tax reporting.

Be prepared

While we have seen high profile cases of countries delaying their e-Invoicing mandate the Belgian approach has been deliberately simplistic, leveraging the existing proven PEPPOL network in order to avoid potential complications around technical architecture and scalability.

Despite the seemingly distant implementation deadline, and the apparent simplicity of the model, businesses still start to prepare for the potential new mandate as soon as practical. If you are already using PEPPOL in Belgium, for example for B2G e-Invoicing, you may find there is less to do. But for those new to PEPPOL there is still some work to be done.

And of course Belgium is just one of many countries now who’s mandate will be coming soon. While Poland have postponed and no date has been set it will almost certainly be a 2025 deliverable, with Germany, Spain and Slovakia also due to begin their mandates in 2025. And 2026 will not only see Belgium introduce a mandate but also of course France, Croatia and Latvia.

For organizations with operations across these countries having to deal with not just one but two, three, four or even more mandates in quick succession will very likely leave you struggling for resources.

Beginning to address your global e-Invoicing strategy now makes a lot of sense.

February 2024 – Malaysia’s clearance e-Invoicing mandate – what we know so far

Malaysia has joined the increasing number of countries to announce a new mandatory e-Invoicing regime. As well as targeting tax compliance and reducing “tax leakages” the system will make tax reporting more efficient. In addition, the stated goals of the mandate include improvement in business efficiency and supporting the digital economy.

While e-Invoicing has been possible since 2015, it has been optional and not widely adopted. The new plans announced by the Inland Revenue Board of Malaysia (IRBM) for a Continuous Transactional Controls (CTC) mandate will be phased in over a period of years based on company revenue.

MyInvois portal – high level details

The Malaysian approach includes a central government platform, called “MyInvois” which will validate invoices; hence it is classed as a clearance model. The MyInvois platform will approve invoices prior to issuance and add a unique digital Certification Serial Number to the invoice. Once verified the supplier must share the validated e-Invoice with the buyer / customer.

Companies can either connect directly to the MyInvois portal or use their own application as long as it is able to integrate via the published Application Programming Interface (API).

For those with low volumes of invoices, connecting to MyInvois directly is possible. Here, invoices can be entered manually through a web form, or uploaded either individually or as a batch using a spreadsheet. The portal supports all essential e-Invoice actions, including invoice generation, submission, viewing, cancellation or rejection.

Cancellation/rejection needs to occur within 72 hours from the time of validation.

For those using the API option, this can be enabled either through an existing business application such as your ERP as long as it supports the API, or through a service provider. Invoices can be submitted in XML or JSON format.

There are 55 mandatory fields required under the new system as well as additional annexes for certain circumstances.

Invoices that fail to include the mandatory content or are not in the correct format will be rejected automatically.

More details of the functional and technical requirements can be found at the IRBM portal here.

Scope

The scope of the mandate will cover both domestic and cross-border transactions. Both imports and exports will need to be reported to the IRBM MyInvois portal.

Invoices, credit notes, debit notes and refund notes are all in scope of the mandate. Self-billed invoices are also in scope. There are some exemptions which are detailed in the technical specifications available on the IRBM Portal.

Timeline

The initial implementation date of the mandate has been deferred from June 2024 to August 2024 and slightly simplified from four phases to three. The timeline is now as follows:

- For taxpayers with an annual turnover exceeding RM 100 million, the applicable date is now August 1, 2024.

- For taxpayers with an annual turnover between RM 25 million and RM 100 million, the applicable date remains January 1, 2025. This simplifies the timeline by removing an additional phase which had originally been slated for January 1, 2026, for businesses with an annual turnover between RM 25 million and RM 50 million. These are now all included in the earlier date.

- Finally, for all remaining taxpayers, the mandatory e-invoicing implementation starts on January 1, 2027.

February 2024 – France – To PDP, or not to PDP, that is the question

“Whether ’tis nobler in the mind to suffer the slings and arrows of outrageous fortune, or to take arms against a sea of troubles, and by opposing end them?” The famous soliloquy from Hamlet is the crux of the hero’s dilemma. And it echoes the dilemma faced by companies operating in France today. The question at hand: to use a Partner Dematerialization Platform (PDP) or not for the upcoming French e-Invoicing reform.

Act I: The Mandate

“All the world’s a stage, and all the men and women merely players.” In our play, the stage is set by the French government, which has mandated B2B e-invoicing and e-reporting starting from September 2026. The players of course are all of the companies who are operating in France and must adapt to this new reality.

Act II: The Choice

“To be, or not to be, that is the question.” To be a user of a PDP, or not to be? That is the question companies must ask themselves. The PDP, registered and authorized by the French tax authorities, offers more functionalities and flexibility than the public platform (PPF) or a regular, uncertified Dematerialization Operator (OD). It can process any EDI format, provide archiving tools, and offer specific business applications.

- Partner Dematerialisation Platforms (PDPs) are government-certified e-invoicing service providers. They can issue and receive e-invoices directly with the service provider of the buyer without going through the Public Invoicing Portal (PPF). PDPs can convert e-invoices into standard formats such as Factur-X, UN/CEFACT CII, and UBL 2.1 to comply with European Union (EU) norm.

- Dematerialisation Operators (ODs) provide similar functions to PDPs but are not certified by the government. They cannot directly issue or receive e-invoices. Instead, they must use the PPF as an intermediary to perform e-invoicing activities.

Act III: The Considerations

“There is nothing either good or bad, but thinking makes it so.” When choosing whether to use a PDP or not, companies must consider various parameters: the type of invoices they will process, data management concerns, customer/supplier relations, transmission methods, and specific features and functions that they may require. Cost will also be a key criteria, since service providers who certify as a PDP will have significant additional operational costs to achieve and maintain their PDP status.

It’s not a question of good or bad, but of what suits the company’s needs best.

Act IV: The Solution

“Some are born great, some achieve greatness, and some have greatness thrust upon them.” OpenText are a leading provider of e-invoicing solutions and have applied for the role of PDP in France. The list of operators who have submitted their applications can be found on the French tax authority website here.

Of course, applying for PDP status is no guarantee of achieving it and the timelines for certification to complete are still a bit vague. PDP status will only be awarded after the interoperability tests with the public PPF platform are completed. However, as a global and profitable company hosting their own data centers and support infrastructure with the European Union, OpenText remains confident of achieving PDP status.

OpenText intends to operate both as an OD (Dematerialization Operator) and a PDP (Partner Dematerialization Platform) in France, recognizing that not all companies will need all of the features of a PDP.

We are also offering the OpenText e-Invoicing mandate readiness check service to assist customers in assessing the output from their ERP/finance/accounting systems to ensure it meets the requirements of the French legislation.

By partnering with OpenText we can help you achieve greatness in your e-Invoicing journey, and successfully navigate the “undiscovered country, from whose bourn no traveler returns” of e-invoicing with confidence.

Act V: The Conclusion

“All’s well that ends well.” With the right choice of partner, companies can ensure a smooth transition to the new e-invoicing system. The question of “To PDP, or not to PDP” will be answered, and all’s well that ends with successful compliance.

For more details reach out to your OpenText account representative or contact us here.