November 2025

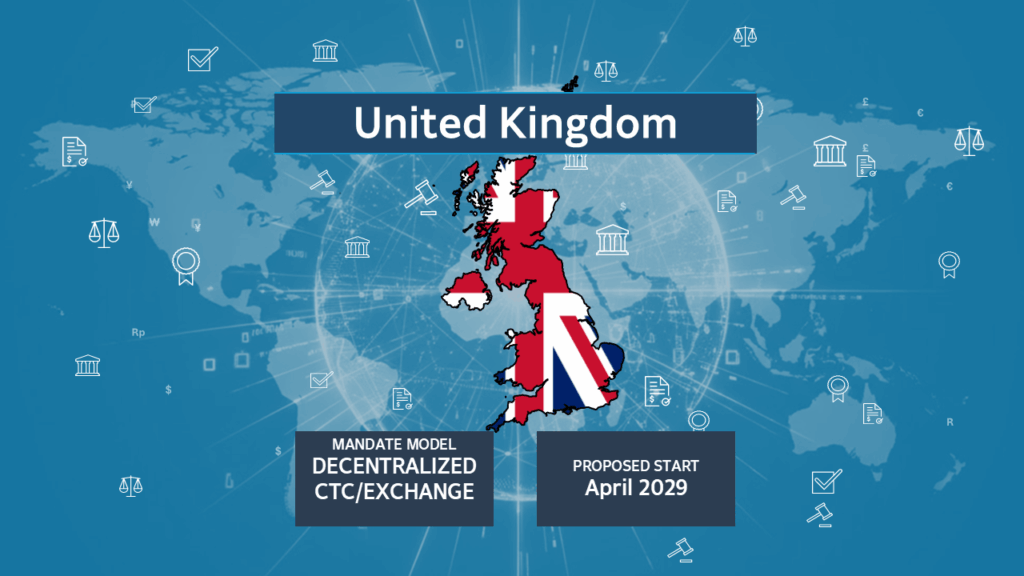

It’s official! The UK mandates e-Invoicing for 2029 – and you heard it here first!

Well, ladies and gentlemen, the waiting game is officially over.

After months of patiently observing HMRC’s quiet review of their e-invoicing consultation, and following their vague-but-committed “Transformation Roadmap”, the government has delivered the definitive answer: mandatory e-invoicing is coming in 2029!

As I pointed out in our August blog, the Transformation Roadmap language sounded decidedly decentralized and for my money was leaning towards a PEPPOL-based interoperability model, so it’s deeply satisfying to see the official response align perfectly with my predictions (and frankly, with common sense).

The Mandate Breakdown: Predictable, yet challenging

HMRC’s decision to introduce mandatory e-invoicing for all VAT invoices from 2029 is a game-changer. This isn’t just about a nudge towards digital; it’s a commitment to joining the global CTC (Continuous Transaction Controls) movement that’s already sweeping Europe.

But here’s where the “I told you so” moment gets interesting (in the nicest possible way, of course):

- The Model is Decentralized: The government explicitly favors a decentralized model, aligning perfectly with the inference we drew from the Transformation Roadmap last August, which suggested HMRC would rely on intermediaries/software providers instead of building a massive, monolithic government portal. This also aligns perfectly with our previous analysis that a decentralized model is the best model to serve the needs of UK businesses.

- The PEPPOL Hunch: Our earlier suggestion that we shouldn’t “bet against a PEPPOL based model” looks increasingly solid. The decentralized model is compatible with the existing MTD framework and strongly suggests leveraging the proven standards used successfully by the NHS for e-procurement.

Why the Rush? It’s all about the cash!

For a country that has been happy to “sit back and observe” e-invoicing in others, this 2029 deadline may feel fast. But the drivers are impossible to ignore:

- The VAT Gap: While MTD addressed the VAT return, e-invoicing tackles the transaction level, helping to close the VAT gap (estimated at £8.1bn in the 2022-2023 tax year).

- The Late Payments Plague: This is the big one. The mandate is intended to solve the business pain point of late payments, with research showing e-invoicing can reduce late payments by 20% and save small firms £11,300 annually. That’s real, tangible ROI.

Compliance will be an integration challenge

This decentralized, standards-based approach creates a huge network integration challenge—which is fortunately exactly where we shine.

We have long advocated that the ideal model serves both the tax agency and businesses. The decentralized model achieves this, but for large multinationals it will require an integration partner to simplify the complexity:

- 100% Community Enablement: The new mandate ensures all suppliers must comply, forcing even small and micro businesses to engage. Our platform specializes in providing scalable enablement tools to onboard every trading partner quickly and cost-effectively.

- Decentralized Mastery: We already connect to decentralized platforms across Europe (like Chorus Pro in France) and are key players in the PEPPOL network. This means we aren’t scrambling to adapt; we already live here.

- Integration is our Core: Forget the piecemeal, multi-vendor approach. We solve the core problem by integrating your ERP, finance, and procurement systems into a single data process flow, reducing processing time, cutting costs by 60-80%, and simplifying the inevitably complex UK standard.

The starting gun has officially been fired. 2029 is much closer than you think when you consider the complexity of multi-country integrations and data readiness.

Don’t let the UK become a last-minute compliance headache. Instead turn this mandate into a huge competitive advantage.

Reach out to your OpenText account representatives today to discuss the implications.

August 2025

HMRC’s Transformation Roadmap – early days, but inferences may be drawn

If you’ve been following our coverage of the UK’s e-invoicing journey, you’ll know things have hit a quiet patch. After HMRC’s 12-week consultation (see below), there has been a natural lull while they review the input.

HMRC’s Transformation Roadmap

On July 21, 2025, HMRC published a new document—their “Transformation Roadmap.” While the main body of the document doesn’t explicitly mention electronic invoicing, a closer examination reveals a clear commitment. Tucked away in Annex B, we found this key line:

“HMRC will: Explore increasing the adoption of e-invoicing as a means of reducing administrative burdens, improving cashflow, and reducing errors for VAT customers.

So the good news is, HMRC definitely has e-Invoicing in the plan, but it’s clear things remain very much in the early stages. The roadmap, then, is more of a high-level vision than a step-by-step timeline. It’s short on specifics and long on lofty goals, but their stated aim of reaching a “digital-first” tax system by 2030 gives some idea of the timelines that they are shooting for.

We can also draw a few other inferences if not conclusions from the language used. Consider this quote from the roadmap itself (emphasis mine):

“HMRC envisages that the role of intermediaries in administering the tax and customs system will increase. Intermediaries, such as software providers, are already becoming more integrated into customers’ existing processes and systems. This integration allows for AI and other technological innovations to automate fulfilment of customers’ tax and customs obligations.“

This statement seems to point towards a decentralized model, where the government relies on private software providers, like OpenText, to handle the technical heavy lifting of e-invoicing. It suggests that instead of building a massive, all-encompassing government portal, HMRC intends to leverage the existing market of service providers.

Elsewhere in previous documents HMRC has mentioned PEPPOL – no surprise given the success seen by the NHS in their national roll-out for e-procurement. If I were a betting man I would certainly not want to bet against a PEPPOL based model for the UK by 2030.

“Wait and learn”

It’s clear that the UK has been quietly sitting back and observing the implementation of e-Invoicing in other countries – the successes of the PEPPOL-based models and the stumbles of some centralized systems. But the result is that HMRC is now in a good position to design a model that works for its unique ecosystem.

However, in the short term this also means a degree of vagueness and uncertainty for businesses.

What is clear is that a “digital-first” approach is no longer merely an aspiration but an explicit goal. While the timeline is still being decided, the line in the sand drawn by the Transformation Roadmap is undeniable. 2030 is not that far away at all now, a mere five years. This means companies need to start considering the implications now. For UK Headquartered multinationals with operations across Europe now is the time to consider your overarching e-Invoicing strategy. With mandates coming soon in Belgium, Poland, France, Croatia and others it’s vital that businesses take the long term view and invest in a platform that can scale to meet the tidal wave of e-Invoicing reforms on the way.

So, let’s keep calm and carry on for now while monitoring the evolution of HMRC’s digital transformation roadmap. The UK may be a late starter in the e-invoicing race, but it looks like the starting gun has finally been fired.

You can find a full copy of HMRC’s Transformation Roadmap here, and the Annex B here.

OpenText are committed to supporting our customers and prospects through the UK’s journey. Stay tuned for more updates when we have them, and learn how to simplify mandates and unlock measurable ROI with OpenText’s e-Invoicing Solutions.

February 2025

New developments in HMRC’s e-Invoicing consultation

As you saw in my previous blog post back in September 2024, the UK government announced an open consultation on promoting electronic invoicing (e-invoicing) across businesses and the public sector. Now, there’s exciting progress to share!

Key Aspects of the Consultation

The consultation, which is a significant step towards standardizing e-invoicing in the UK, has now officially kicked off. Commencing on February 13, 2025, it will run until May 7, 2025. This consultation aims to gather a wide range of views on how best to implement e-invoicing. The goal is to enhance business productivity, improve cash flow, reduce administrative burdens, and minimize errors in tax returns.

One of the key aspects being explored is whether e-invoicing should be voluntary or mandatory. There’s also a lively discussion on the merits of centralized versus decentralized models and the potential for real-time reporting. The government is keen to hear from businesses of all sizes and sectors to ensure the approach developed is both practical and beneficial.

To facilitate this, HM Revenue & Customs (HMRC) and the Department for Business & Trade (DBT) are organizing various events to engage with businesses and gather their input. This is a fantastic opportunity for businesses to have their say and help shape the future of invoicing in the UK.

Benefits of e-invoicing

From our perspective, the benefits of a mandatory e-invoicing regime to both businesses and tax agencies are clear. For businesses, automating all inbound and outbound invoice transactions substantially reduces the overhead of labor-intensive manual processes, virtually eliminates errors, and significantly reduces late payments. This will have real cash flow benefits for businesses at a time when the economy is struggling.

For tax agencies, a mandatory e-invoicing regime delivers greater visibility into the economy and significantly reduces the time and cost associated with tax audits. Many tax agencies have seen a significant reduction in their VAT gap as a result of such mandatory e-invoicing reforms, potentially representing billions of pounds in additional revenue for the UK.

Models and approaches

However, it is vital that any mandate must put the needs of businesses first. Many of our customers here in the UK have been invoicing electronically for decades, leveraging the existing provisions in UK tax law for voluntary e-invoicing. Forcing them to change a process that has worked reliably for years is unnecessary.

While we have seen many different models implemented globally, the best model for e-invoicing that serves the needs of both the tax agency and businesses has proven to be a decentralized one. Unlike the centralized or clearance models used in Italy and proposed in Poland, a decentralized model does not force taxpayers to use a central government portal to deliver their invoices. A decentralized model allows suppliers to send e-invoices directly to their buyers. In parallel, real-time or near-real-time reports of invoice transactions can be transmitted to a government portal to provide visibility to HMRC, as has been proposed in countries such as France, Greece, Croatia, Latvia, and others. This approach minimizes disruption to businesses that have already implemented e-invoicing while giving those who have not yet done so maximum flexibility in how to send or receive e-invoices.

Participating in the consultation

For more information about the consultation process and details of how to submit your responses to HMRC, see the official documentation here.

If you’d like to discuss the different approaches laid out in the consultation in order to better respond to the consultation, please feel free to reach out to your OpenText account representatives who can arrange a discussion with our subject matter experts, or contact us here.

Stay tuned for more updates as the consultation progresses.

September 2024

Embracing the future: HMRC announce consultation on mandatory e-Invoicing

The UK government has recently announced an exciting development that could revolutionize the way businesses handle invoicing. As part of a broader package of reforms, His Majesty’s Revenue and Customs (HMRC) will soon launch a consultation on the implementation of mandatory electronic invoicing (e-Invoicing) across UK businesses and government departments.

A step towards digital transformation

This consultation marks a significant step towards a digital-first approach, aiming to streamline administrative tasks, improve cash flow, boost productivity, and reduce errors in tax returns while enhancing overall business efficiency.

From the government’s perspective, this is seen as a key initiative in improving the UK’s tax system and helping to fix the foundations of the UK economy, and close the VAT gap, which at last count (2022-2023 tax year) was estimated to be approximately £8.1bn.

What does this announcement mean?

This is exciting news for all UK businesses. While e-Invoicing has been an option for businesses for many years, its adoption has been hampered by limitations derived from the European Union VAT Directive (Council Directive 2006/112/EC). This directive included provisions that allowed buyers to refuse electronic invoices, insisting on paper instead.

HMRC VAT Notice 700/63 outlines the conditions for e-Invoicing, transposing many key conditions from the EU VAT directive, including the obligation for buyer acceptance. This has been a major barrier to widespread adoption.

However, recent e-Invoicing mandates in Europe have reversed this restriction, preventing buyers from vetoing electronic invoices and mandating that all invoices be exchanged electronically.

The benefits of mandatory e-Invoicing

The implementation of a mandate will have many benefits, not just for the UK government, but for businesses.

- Efficiency: Automating invoicing processes reduces manual errors and saves time.

- Cost Savings: Lower administrative costs and faster payment cycles.

- Environmental Impact: Reducing paper usage contributes to sustainability efforts.

- Tax compliance: Ensures adherence to the latest tax regulations and reduces the risk of compliance errors and fraud

Looking ahead

As HMRC prepares to gather input from businesses on how to best implement e-Invoicing, we encourage our customers to participate in the consultation process. Your feedback is invaluable in shaping a system that works for everyone.

As a global provider of e-Invoicing services, OpenText we have long supported the existing optional regime for B2B e-Invoicing in the UK and have been a key player in providing PEPPOL-based e-Invoicing solutions for the NHS. Our commitment to innovation and excellence means we are well-prepared to support any new mandatory regime that the UK government might propose.

We are committed to supporting our customers and prospects through this transition and beyond. Stay tuned for more updates as we navigate this exciting journey towards a more efficient and digital future.

For more details of HMRC’s announcement, see the official press release on the UK government’s website here. Learn more about OpenText e-Invoicing solutions.

Disclaimer: This blog is intended to reflect the direction the industry is moving and does not a reflect a commitment for the OpenText Trading Grid e-Invoicing (formerly Active Invoices with Compliance) product development roadmap to meet any particular stated regulations.

LEGAL Disclaimer: The information contained in this newsletter is for general guidance on matters of interest only. The authors are not herein rendering legal, accounting, tax or other professional advice and the content should not be used as a substitute for consultation with professional accounting, tax, legal or other competent advisers. While we make every attempt to ensure the accuracy of the information contained within is from reliable sources, OpenText is not responsible for any errors or omissions, or for any result.