General Motors was a company facing challenges when they hired Daniel Akerson as CEO in 2010. His background was tied to financial analytics so it’s not a surprise that they then acquired AmeriCredit in an all-cash transaction valued at approximately $3.5 billion.

Daniel Akerson commented that he started “creating world-class systems in our IT and financial systems, to quickly capitalize on opportunities and protect product programs from exogenous risk“. Fortune magazine announced recently that General Motors was working on the future of driving, which it believes will be “connected, seamless and autonomous.”

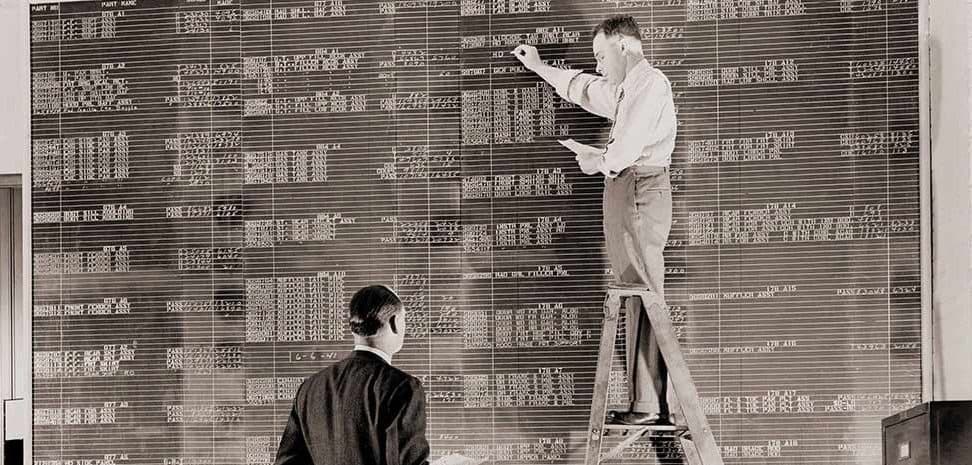

Chief Financial Officers are not renowned for underestimating the power of innovation and statistics, better known today as “analytics.” Accenture has defined the CFO as the “Architect of Business Value,” yet if we go back to 2014, we may recall many companies had deep silos of inconsistently defined, structured data that made it difficult to extract information from different parts of the business.

We all know that, so what’s new for financial analytics?

1) Big data is getting bigger with the Internet Of Things

Having accurate data is still critical. ′In God we trust, all others must bring data′ said engineer and statistician W. Edwards Deming. We all agree that not all data is useful, but the wider the data source range, the more accurate the 360º view; so the challenge in a world with 6.4 billion connected devices is even bigger and finance organizations are challenged.

2) Digital is killing the finance organization

Big data coming from new structured and unstructured data sources are increasing risk but also offering new opportunities. Growing opportunities to store and analyze data from disparate sources is driving many leaders to alter their decision-making process. The number of mobile banking users in the US is now 111 million, in 2010 there were just 35 million as a comparison and today banks adopt e-commerce tactics, tracking customers through mobile to reduce churn and increase sales opportunities.

3) Data gravity will pull financial analytics to the cloud

Cloud data warehousing is becoming widely adopted, so the question for Information Technology now is “When?” When your data is already in the cloud, you better have analytics right there. Having your data within OpenText™ Cloud has the benefit of being with the leader in Enterprise Information Management and being able to load data via the front-end or back-end within a columnar database.

4) Compliance audit is still a challenge

Self-service data preparation is becoming key to better data audit. Analysts are saying that the next big market disruption is self service data preparation and that by 2019 it will represent 9.7% of the global revenue opportunity of the business intelligence market.

OpenText™ Big Data Analytics, for example, provides financial analysts with easy-to-use tools for self-service data preparation like the following:

- Data preparation – tools like normalization, linear scaling, logistic scaling or softmax scaling

- Data enrichment – aggregates, decodes, expressions, numeric ranges, quantile ranges, parametric or ranking

- Data audit – count, kurtosis, maximum, mean, median, minimum, mode, skewness, sum, or standard deviation

5) Organizations should focus analytics on decisions, not reporting

Analysts introduced the concept of the algorithmic business to describe the next stage of digital business and forecast that by 2018, over half of large organizations globally will compete using advanced analytics and proprietary algorithms, causing the disruption of entire industries.

6) Analytics is not only about reporting any more

Analytics is maturing and priorities are naturally focused on the business. Algorithms will not only provide insights and support decision-making, but will be able to make decisions for you. 49% of companies are using predictive analytics and a further 37% are planning to use it within 3 years.

Predictive analytics with big data has been the cornerstone of a successful financial services organization for some time now. What’s new is how easily any business user can access predictive insights with tools like OpenText™ Big Data Analytics.

According to Francisco Margarite, CIO at Inversis Bank, “extracting and analyzing information used to take a considerable amount of time of our technical experts, and as a consequence, we were not providing the appropriate service. Now, we have provided more user autonomy and reduced the work overload in IT.”

Here are some examples of how analytics can help:

- Venn Diagram: Identify which customers that purchased “Insurance A” and “Insurance C” did not purchase “Insurance B”, so you can get a profile and a shared list.

- Profile: Identify variables that describe customers by what they are and what they are not, so your company can personalize campaigns.

- Decision Tree: Identify which real estate is the most appropriate for each prospect according to the profile and features of the product – price, size, etc. Human Resources will probably find it useful analyzing social data to recruit people who already have an affinity with the company or its products.

- Forecast: Anticipate changes, trends and seasonal patterns. You can accurately predict sales opportunities or anticipate a volume of orders so you can also anticipate any associated risks. You can use sensor data to predict the failure of an ATM cash withdrawal transaction for example.

Subscribers are also able to run easy-to-use pre-built Clustering, Association Rules, Logistic Regressions, Correlations, or Naive Bayes.

7) Financial data is the leading indicator when using analytics to predict serious events

Recent cases like CaixaBank or MasterCard prove that there is growing interest in using analytics to get ahead of social and political developments that affect corporate, and sometimes national interests. Financial data is a leading indicator. Now, we can also look at big data from social media to determine sentiment.

8) What will make emotional analytics really helpful is to have a stronger analytics model behind it

Risk or fraud can now be identified by sentiment analysis on social media, so you could determine future actions. But, if you look at sentiment or emotion alone, it essentially flags a lot of false positives.

9) The need to manage, monitor, and troubleshoot applications in real-time has never been more critical

Digital transformation grows as the reliance on new software grows, so the need for full-stack visibility and agility is the true business demand underpinning the growth of analytics.

10) To know your customer and to deliver relevant data is a key business differentiator

TransUnion, for instance, reported profit for 2015 after booking losses since 2012, when moving from relational databases to predictive and embedded analytics. Before the overhaul, IT spent half its time maintaining older equipment. About 60% of capital spending went to managing legacy systems, now it′s 40% to 45%, they said.

First things first – no matter if you are forecasting risk of fraud, crime, or financial outcomes, once you have the insight from predictive analytics, you will need a way to communicate this to the right person. 77% of companies cite predictive capabilities as one of top reasons to deploy self-service business intelligence, but increasing loyalty by improving customer satisfaction is also a very relevant reason.

Firms can now deliver a tailored, personalized experience where customers enjoy self-service access to their own account data and history, and are proactively provided recommendations and information about additional products and services to:

- Drive increased revenue via cross selling, by automatically suggesting new products and services to targeted customers

- Engage customers by providing self-service access to personal views of account data on any device

- Increase loyalty by enabling customers to interactively customize how they analyze their financial data

- Realize a more rapid time to market by leveraging its APIs to embed new features in existing customer applications

OpenText™ Information Hub is providing great embedded analytics according to Dresner, and also offers insights from predictive analysis because of its unique integration with OpenText Big Data Analytics.